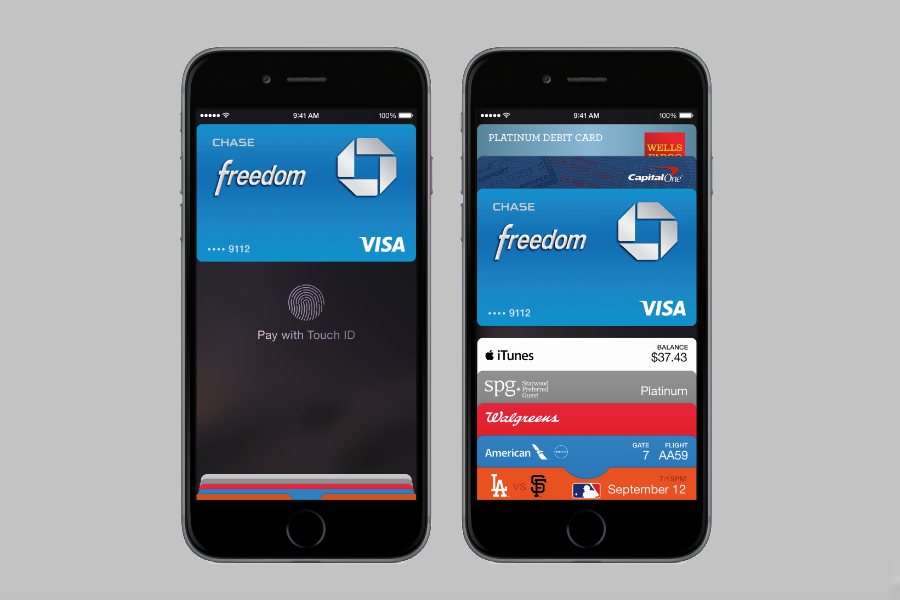

Apple has launched its latest release Apple Pay on Oct, 20. Apple Pay is a mobile payment system which can be done through iPhone 6 or 6 plus. Customer has to enter credit card information & make the payments via phones. And Apple Pay has already been accepted by 220,000 stores: to name a few: Whole Foods, Walgreens, McDonald’s, Macy’s & Nike. And still more retailers are expected to join Apple Pay.

Digital executive director of Chase Bank, Avin Arumugam has told that more people have connected their credit card to Apple Pay seven times than any other credit card sign up. And if this trend of Apple Pay continues in the same way & gain more popularity among the Customers & Retailers, than there will be more number of users would switch to iPhone. And according to Forester Research: through Apple Pay mobile payment market will soar from $12.8 billion in 2012 to $90 billion in near 2017. Though other companies like Google, PayPal, and Verizon & AT&T have tried mobile pay market but were unsuccessful & have not gained popularity. Now Apple Pay with its initial success may prove to be the most sought out mobile payment system.

“Apple actually has a really good shot at being successful here because they’ve solved a lot of fundamental issues that others haven’t in the past,” Patrick Moorhead, president of Moor Insights & Strategy, told The New York Times. “In particular, the user experience issue. It’s simple, easy, and secure to use.”

After one week of Apple Pay release & with its initial success of its popularity with customers also but then too some retailers like Wal-Mart, CVS, Rite Aid & MCX members rejected Apple Pay usage on their stores. As per Market Analysts, This move of rejection of Apple Pay by CVS & Rite Aid’s is in favor of their system. MCX is working on mobile payment software, CurrentC, which will be linked directly to the Debit account of Consumer’s & not the credit card. Even CVS & Rite Aids also mentioned that they are evaluating mobile payment options. And Best Buy & Wal-Mart as the members of MCX rejected Apple Pay.

In a statement to Business Insider a Wal-Mart spokesperson wrote: There are certainly a lot of compelling technologies being developed, which is great for the mobile-commerce industry as a whole. Ultimately, what matters is that consumers have a payment option that is widely accepted, secure, and developed with their best interests in mind. MCX member merchants already collectively serve a majority of Americans every day. MCX’s members believe merchants are in the best position to provide a mobile solution because of their deep insights into their customers’ shopping and buying experiences.